For example, if the IRS flags a tax deduction they deem suspicious, you can easily trace the number back to your ledger to double-check its accuracy and provide support for the write-off. Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success. Searching for and fixing these errors is called making correcting entries. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.

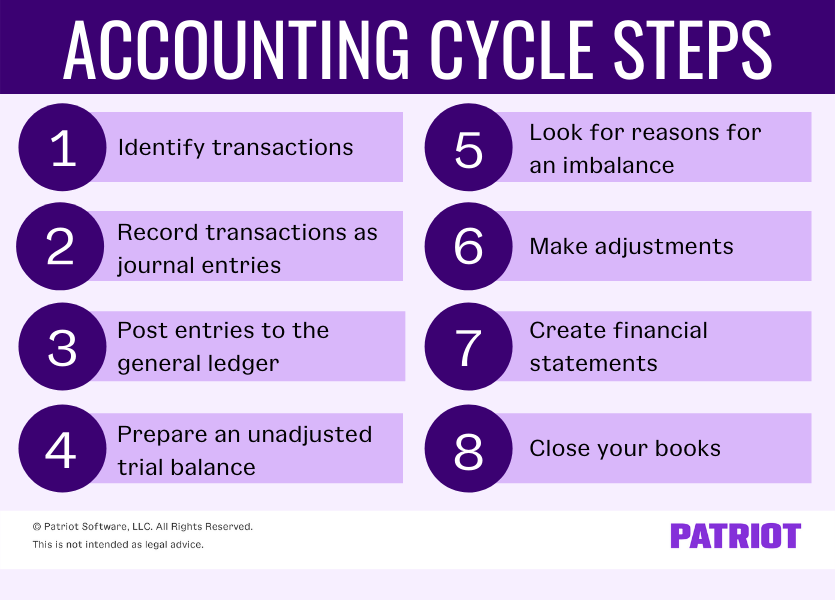

The Accounting Cycle: 8 Steps You Need To Know

Once a transaction is recorded as a journal entry, it should post to an account in the general ledger. The general ledger provides a breakdown of all accounting activities by account. This allows a bookkeeper to monitor financial positions and statuses by account.

Are bookkeeping and accounting different?

You can do this in a journal, or you can use accounting software to streamline the process. Once you’ve converted all of your business transactions into debits and credits, it’s time to move them into your company’s ledger. In the first step of the accounting cycle, you’ll gather records of your business transactions—receipts, invoices, bank statements, things like that—for the current accounting period. These records are raw financial information that needs to be entered into your accounting system to be translated into something useful. The general ledger serves as the eyes and ears of bookkeepers and accountants and shows all financial transactions within a business.

What is an accounting cycle process example?

The accounting process consists of activities involved in preparing financial statements and includes identifying, recording, and summarizing a business’s financial transactions. xero vs quickbooks is the series of steps required to complete the accounting process. Because the accounting process repeats with each reporting period, it’s referred to as the accounting cycle. It starts with recording all financial transactions throughout that accounting period and ends with posting closing entries to close the books and prepare for the next accounting period. It’s worth noting that some businesses also have internal accounting cycles that have a shorter accounting period. These internal accounting cycles follow the same eight accounting cycle steps and can last anywhere from one month to six months.

Identify Transactions

Crediting is where you’ll make adjustments to accounts in your general ledger. For example, if you receive a payment from a customer, you need to make sure that payment was properly credited to their accounts receivable balance. All adjustments, debits, and credits should be factual, or you risk errors in your financial statements, which could lead to later tax reporting and payment issues. Another name widely used for Profit & loss statements is the income statement which represents the company’s expenditures and revenues over a given period of time. The structure of the Profit and loss account is different from the Balance sheet statement which predicts a line-wise reporting style. The main content and items of the Profit and loss account include the revenues, cost of goods sold, gross profit, all expenses, and the year-end income.

Identify and analyze transactions during the accounting period.

- You can then show these financial statements to your lenders, creditors and investors to give them an overview of your company’s financial situation at the end of the fiscal year.

- For example, public entities are required to submit financial statements by certain dates.

- However, the most common type of accounting period is the annual period.

- For example, all journal entry records made to “Cash” are posted into the Cash account in the ledger.

- If financial activity goes unidentified, it cannot be reviewed or monitored by the business.

- Businesses need to conduct the eight-step accounting cycle for each accounting period.

An adjusted trial balance may be prepared after adjusting entries are made and before the financial statements are prepared. This is to test if the debits are equal to credits after adjusting entries are made. The accounting cycle is a comprehensive accounting process that begins and ends in an accounting period.

It’s time to go through the various transactions the business saw over the past quarter, including sales and expenses, like supplies and delivery costs. Ray reviews his sales journal, bank account statements, and credit card statements for the quarter, checking each transaction and confirming its accuracy. Double-entry bookkeeping refers to recording every transaction in at least two accounts — a Debit on one side and a Credit on the other. This recording system provides a system of checks and balances in the company’s books and helps prevent fraud and errors. A business’s accounting period depends on several factors, including its specific reporting requirements and deadlines. Many companies like to analyze their financial performance every month while others focus on quarterly or annual reports.

Book review calls or send messages to get prompt answers to your questions so your financial health is never a mystery. First, an income statement can be prepared using information from the revenue and expense account sections of the trial balance. This new trial balance is called an adjusted trial balance, and one of its purposes is to prove that all of your ledger’s credits and debits balance after all adjustments. Journal entries are usually posted to the ledger as soon as business transactions occur to ensure that the company’s books are always up to date. The total credit and debit balance should be equal—if they don’t match, there’s an error somewhere. The unadjusted trial balance is the initial version of the trial balance that hasn’t been analyzed for accuracy and adjusted as needed.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Throughout this section, we’ll be looking at the business events and transactions that happen to Paul’s Guitar Shop, Inc. over the course of its first year in business. Some textbooks list more steps than this, but I like to simplify them and combine as many steps as possible. You might find early on that your system needs to be tweaked to accommodate your accounting habits. Tax adjustments help you account for things like depreciation and other tax deductions. For example, you may have paid big money for a new piece of equipment, but you’d be able to write off part of the cost this year.

Meanwhile, the remaining five steps are the bookkeeping tasks you do at the end of the fiscal year. Fortunately, nowadays, you can automate these tasks with accounting software, so doing all this isn’t as time-consuming as it might seem at first glance. A shorter internal accounting cycle can make bookkeeping more manageable, especially when the company’s finances are complicated. However, businesses with internal accounting cycles also follow the external accounting cycle of the fiscal year.